capital gains tax philippines

August 10 2015. Net capital gain is the difference between the selling price and the FMV of the shares whichever is.

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq

Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the seller from the sale exchange or other disposition of capital assets located in the Philippines.

. The property is directly and jointly owned by. To calculate the capital gains tax you check the value of the property or its current fair market value whichever is higher and multiply that by 6. - The provisions of Section 39 B notwithstanding a final tax of six percent 6 based on the gross selling price.

In arriving at effective capital gains tax rates the Global Property Guide makes the following assumptions. Philippines capital gains tax. A Computation of capital gains tax due on the exchange of property by Mr.

Capital gains generally are subject to the ordinary income tax rates although gains from the sale of certain shares and real property are subject to specific rates. According to the Philippine Tax Code Capital Gains Tax is a tax that is imposed on earnings that the seller has gained from the sale of capital assets. Capital Gains from Sale of Real Property.

A Capital Gains Tax is imposed on the gain that the seller gets from a sale exchange or other. August 23 2022 at 529 am Hi Attys my question is the CGT was. Capital gains from the exchange or other disposition of real property located in the Philippines.

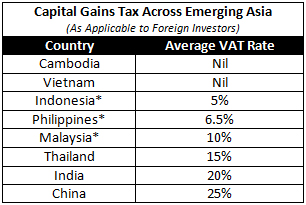

Philippines capital gains tax is calculated at i 15 of the net capital gains realised during the taxable year from sale barter exchange or other disposal of. 186 thoughts on Capital Gains Tax in the Philippines Rate to use How to Calculate and Pay Cutie. Capital Gains Tax is.

Buendia for the reason that there has been full. Capital gains tax CGT is imposed on both domestic and foreign sellers. Buendia No capital gains tax is due from Mr.

According to section 24C of the National Internal Revenue Code of the Philippines NIRC the capital gains tax rate of six percent 6 is based. For example if the property is. Capital gains taxes.

Which means the price of the shares and the associated. City Provincial Information. 1 In General.

The tax charge is 5 for the primary P100000 and 10 in extra of P100000 of the web capital positive factors. The Withholding of Creditable Tax at Source or simply called Expanded Withholding Tax is a tax imposed and prescribed on the items of income payable to natural or juridical persons residing. Gross amount of income derived from all sources within the Philippines.

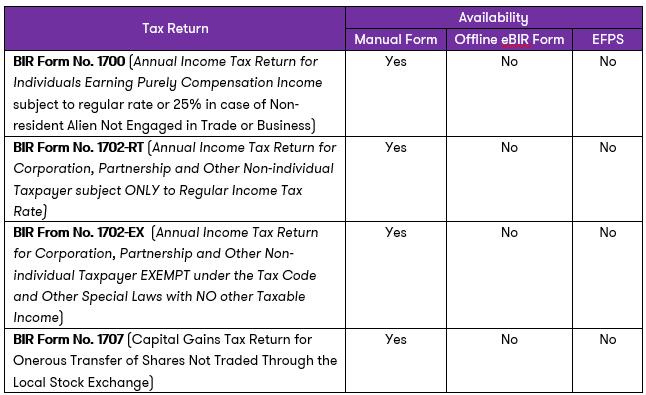

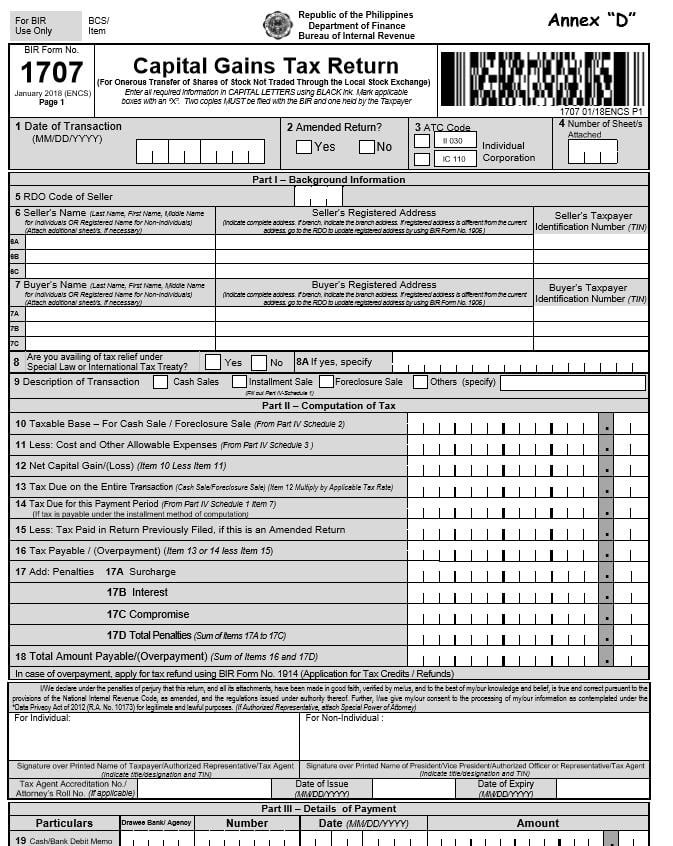

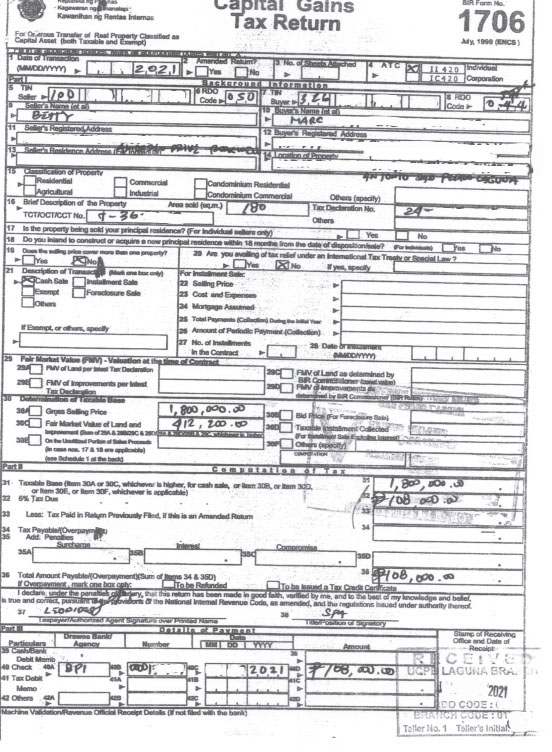

The Capital Gains Tax Return BIR Form No. 1706 shall be filed in triplicate copies by the SellerTransferor who are natural or juridical whether resident or non-resident including Estates. D Capital Gains from Sale of Real Property.

Q A What Is Capital Gains Tax And Who Pays For It Lamudi

Capital Gains On Selling Property In Orlando Fl

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

Chile Indirect Transfer Of Assets And New Withholding Provisions

Capital Gains Yield Cgy Formula Calculation Example And Guide

Capital Gains Tax How To Fill Up Bir Form 1706 Youtube

How To Compute Capital Gains Tax Train Law Youtube

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax China Briefing News

How To Calculate Capital Gains On Sale Of Gifted Property Examples

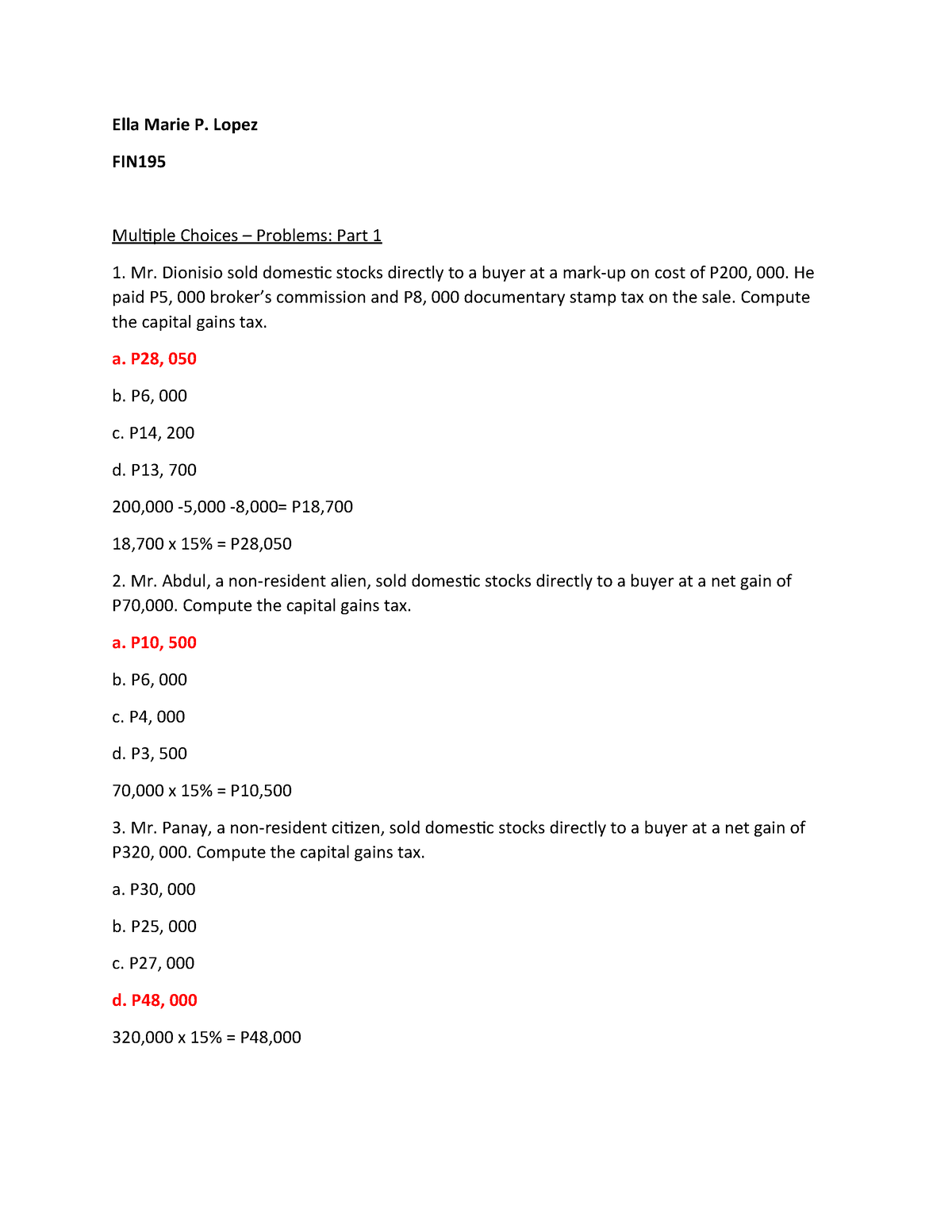

Capital Gains Tax Ella Marie P Lopez Fin Multiple Choices Problems Part 1 Mr Dionisio Sold Studocu

Capital Gains Tax Exemption Philippines With Sample Computations Youtube

New Annual Income Tax And Capital Gains Tax Returns Grant Thornton

Capital Gains Tax Exemption Philippines With Sample Computations Youtube

How To Compute File And Pay Capital Gains Tax In The Philippines An Ultimate Guide Filipiknow

Duterte S Economic Managers Not Concerned About Below Target Yield From Train Gma News Online

Taxes And Title Transfer Process Of Real Estate Properties This 2021

How Are Dividends Taxed Overview 2021 Tax Rates Examples

How To Compute Capital Gains Tax On Sale Of Real Property Business Tips Philippines